Employee Payroll Software for Small Businesses

Payroll can be a time-consuming, administrative task for the small business owner. Our software is an easy-to-use yet powerful tool that gives time back to you. Run quick, seamless payroll—and save time and money along the way—with MDOS Employee Time Clock and Employee Payroll Software.

With MDOS payroll software, you can:

- Run payroll in minutes and eliminate manual errors

- Give your employees the option to request a portion of their earned wages before payday

- Have flexible pay period (Weekly, Biweekly, Semimonthly or Monthly)

- Work for hourly rate employees and salary employees

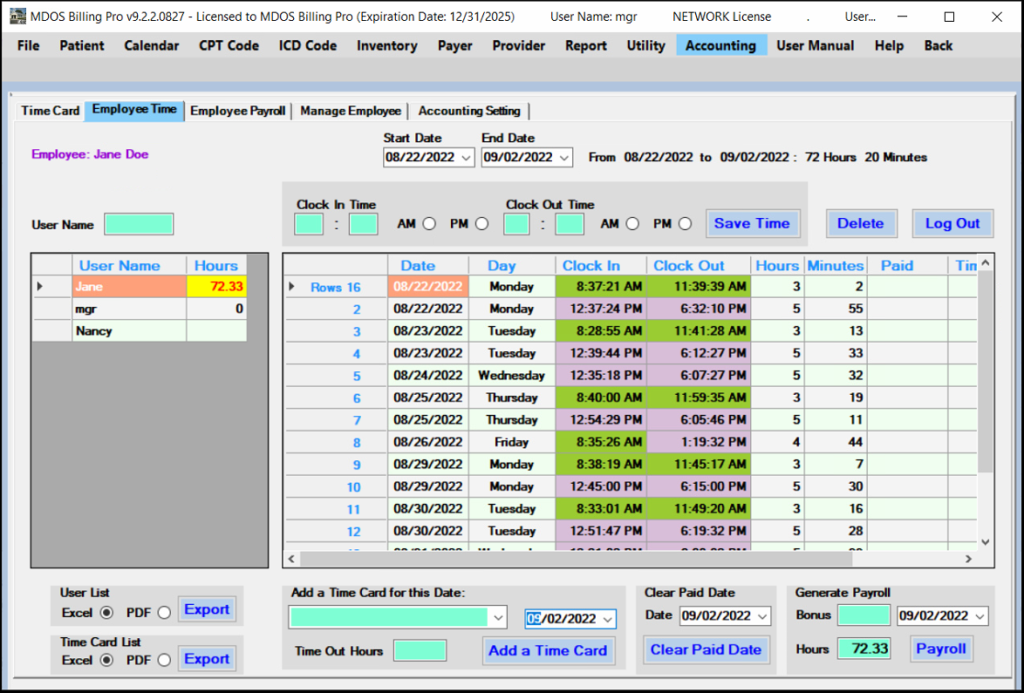

Employee Hours Worked

Employee hours worked from employee time clock is used in the employee payroll.

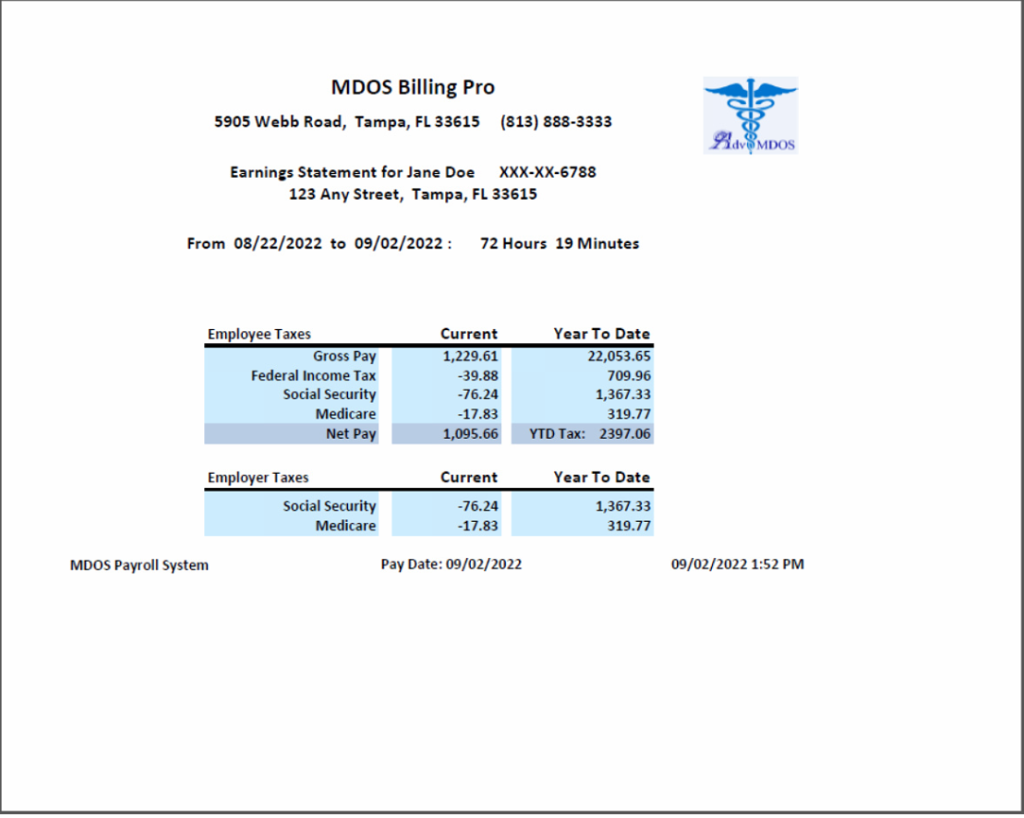

Employee Payroll Statement

Generate employee payroll statement for hourly employees and salary employees. Employee payroll works with employee time clock seamlessly.

The amount of tax withheld is based on the amount of payment subject to tax. Withholding of tax on wages includes income tax, social security and Medicare, and a few taxes in some states. Certain minimum amounts of wage income are not subject to income tax withholding. Wage withholding is based on wages actually paid and employee declarations on federal and state Forms W-4. Social Security tax withholding terminates when payments from one employer exceed the maximum wage base during the year.

Payroll software is available for these states without income taxes: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming. Other states with state income taxes can be added for upon request.

Employee Tax Withholding

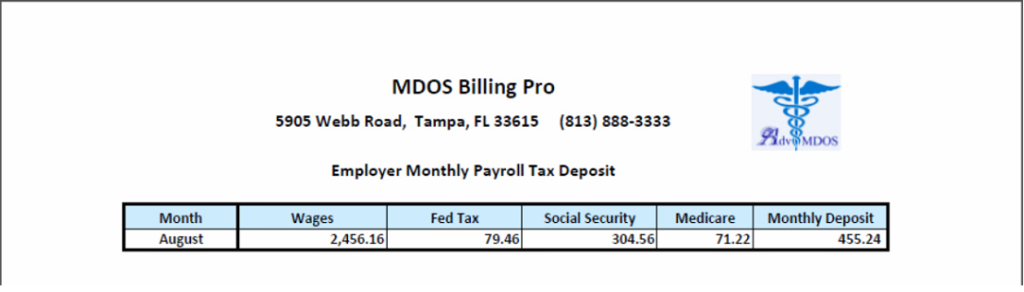

Amounts withheld by payers (employers or others) must be remitted to the relevant government promptly. Amounts subject to withholding and taxes withheld are reported to payees and the government annually.

MDOS Employer Monthly Payroll Tax Deposit report list the monthly wages, fed tax, social security tax, Medicare, and the monthly tax withholding deposit amount.